In the changing world of insurance, we are witnessing new technologies making traditional ways of doing things different. Among these innovations, chatbots have emerged as powerful tools, revolutionizing claims processing and policy management.

In this exploration of the role of chatbots in insurance, we will delve into the transformative potential of these AI-driven assistants. As we look ahead to 2024, the horizon of insurance is defined by efficiency, personalization, and seamless interactions.

The Future of Chatbots in Insurance in 2024

The year 2024 will be a pivotal moment in the insurance sector, with chatbots standing at the forefront of transformative technologies. These intelligent assistants are set to redefine the landscape by streamlining claims processing, enhancing customer interactions, and optimizing policy management.

Understanding the difference: Gen-AI vs. Rule-Based Chatbots

Understanding the characteristics and distinctions between General AI (Gen-AI) and Rule-Based Chatbots is crucial for deploying effective insurance chatbot solutions.

Here’s a comprehensive comparative overview in tabular format:

| Feature | Gen-AI Chatbots | Rule-Based Chatbots |

| Adaptability | Learn and adapt to new information and scenarios. | Follow pre-defined rules and responses. |

| Complexity Handling | Handle complex queries and understand context. | Limited ability to handle intricate scenarios. |

| Training Time | Longer training time with continuous learning. | Quick implementation with fixed rule sets. |

| Scalability | Highly scalable due to self-learning capabilities. | Limited scalability without significant rule additions. |

| Context Awareness | Understand and retain context during interactions. | Lack advanced context retention capabilities. |

| Decision-Making | Make decisions based on learned patterns. | Rely on predefined decision trees and logic. |

| Human-Like Interaction | Achieve more natural and human-like conversations. | Tend to have more structured and predictable interactions. |

| Learning Curve | Continuously improve and evolve over time. | Limited evolution once rules are set. |

| Customization | Highly customizable based on evolving needs. | Customization is constrained by predefined rules. |

| Cost Efficiency | May have higher initial costs but potentially lower long-term costs. | Typically lower initial costs but may incur higher maintenance costs. |

Understanding the differentiation between Generative AI (Gen-AI) and Rule-Based Chatbots is crucial. Gen-AI chatbots leverage advanced artificial intelligence to adapt to new information and handle complex scenarios, offering scalability and continuous learning.

On the other hand, Rule-Based Chatbots follow pre-defined rules, providing quick implementation but with limitations in adaptability and scalability.

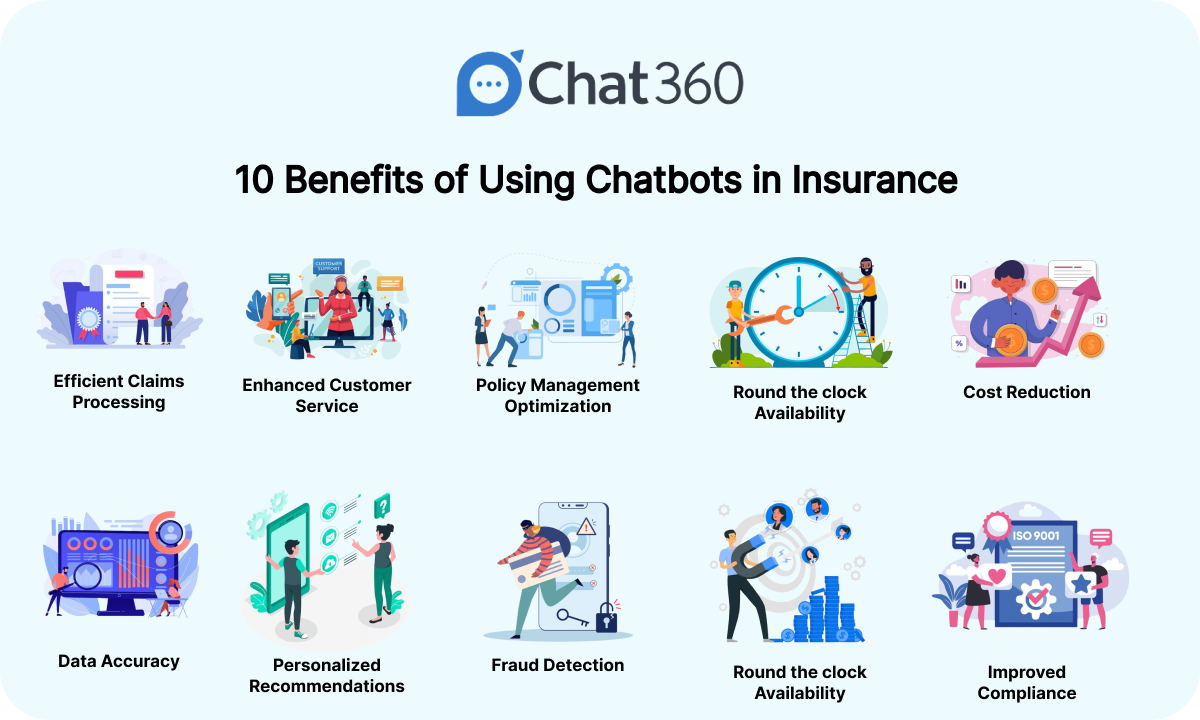

10 Benefits of Using Chatbots in Insurance

- Efficient Claims Processing:

– Accelerate claims processing through automated data extraction and validation.

- Enhanced Customer Service:

– Provide real-time assistance, answer queries, and offer personalized support.

- Policy Management Optimization:

– Streamline policy issuance, modifications, and renewals with automated processes.

- Round the clock Availability:

– Ensure round-the-clock accessibility, addressing customer needs at any time.

- Cost Reduction:

– Cut operational costs by automating repetitive tasks and reducing manual efforts.

- Data Accuracy:

– Minimize errors with precise data extraction and validation capabilities.

- Personalized Recommendations:

– Offer tailored policy suggestions based on customer profiles and preferences.

- Fraud Detection:

– Implement AI algorithms to detect and prevent fraudulent claims.

- Customer Engagement:

– Engage customers through proactive communication and personalized interactions.

- Improved Compliance:

– Ensure adherence to regulatory requirements with automated compliance checks.

9 Use Cases of Insurance Chatbots Across Industries

- Health Insurance:

– Assist policyholders in understanding coverage, processing claims, and managing medical records.

Example: A health insurance chatbot can help a policyholder understand their coverage by providing instant information on covered services, copayments, and deductible amounts. It can also guide them on how to process claims seamlessly through the chat interface.

- Auto Insurance:

– Handle claims processing, provide accident assistance, and offer policy information.

Example: An auto insurance chatbot can assist users in handling claims processing efficiently. In case of an accident, the chatbot can guide users on the necessary steps, collect relevant information, and initiate the claims process. Additionally, it can provide instant updates on policy information.

- Home Insurance:

– Guide homeowners through policy details, claims filing, and property valuation.

Example: A home insurance chatbot can guide homeowners through policy details, ensuring they understand coverage for various events. In the event of a claim, the chatbot can help users file claims, provide necessary documentation guidance, and even assist in property valuation.

- Travel Insurance:

– Assist travelers with policy information, claims during trips, and emergency support.

Example: A travel insurance chatbot can offer instant information on policy coverage for specific destinations. During a trip, it can assist travelers in understanding their coverage, provide emergency contact information, and guide them through the process of filing claims for unexpected events.

- Commercial Insurance:

– Streamline complex policy management for businesses, including claims processing.

Example: A commercial insurance chatbot can streamline policy management for businesses. It can assist in understanding complex policies, managing renewals, and handling claims efficiently. In case of a claim, the chatbot can initiate the process and guide the business through necessary steps.

- Life Insurance:

– Guide beneficiaries through the claims process and offer policy information.

Example: A life insurance chatbot can guide beneficiaries through the claims process with empathy and clarity. It can provide information on necessary documentation, claim submission procedures, and offer support during a challenging time.

- Cyber Insurance:

– Provide businesses with cybersecurity advice, policy management, and claims assistance.

Example: A cyber insurance chatbot can offer businesses advice on cybersecurity measures, policy management, and assist in the claims process in case of a cyber incident. It can guide businesses on preventive measures and steps to take post-incident.

- Crop Insurance:

– Assist farmers with policy information, claims processing, and risk assessment.

Example: A crop insurance chatbot can assist farmers by providing real-time information on policy coverage, guiding them through the claims process for crop-related damages, and offering risk assessment insights based on weather and market conditions.

- Event Insurance:

– Guide individuals or businesses through event-related policies, claims, and coverage details.

Example: An event insurance chatbot can guide individuals or businesses through policies related to events. It can provide information on coverage, assist in customizing policies based on specific needs, and guide users through the claims process in case of event-related issues.

Chat360 Revolutionizing Insurance Processes

In the sphere of chatbot technology, Chat360 emerges as a leading provider, offering tailored solutions for businesses, including the insurance sector. Chat360’s chatbots seamlessly integrate with popular platforms such as WhatsApp, Instagram, Facebook, and websites. The compatibility with CRM platforms ensures efficient management of insurance processes, from claims processing to policy management.

Chat360’s chatbots excel in delivering personalized interactions. By understanding customer preferences and requirements, these chatbots tailor insurance processes to align with individual needs. This personalized approach enhances the efficiency of claims processing, policy management, and overall customer satisfaction.

As we look ahead, the integration of chatbots in insurance processes is poised to redefine efficiency and customer satisfaction. With Chat360 leading the way in providing cutting-edge chatbot solutions, the future promises an insurance landscape characterized by streamlined processes, personalized interactions, and seamless customer experiences.

The synergy between chatbots and the insurance industry marks a transformative journey. The marriage of advanced AI technologies with personalized virtual assistants is not just a technological advancement; it is a revolution in how insurance companies operate. As we embrace these advancements, the insurance industry is poised for a new era of efficiency, personalization, and customer-centric processes.